It is a good estimate that you will probably need 60-100% of your final year’s working salary for each year in retirement. Social security will cover between approximately 20-40% of your pre retirement income at your full retirement age. That is only a fraction of what you will need, and this number varies. To get an accurate estimate of what you could potentially receive from Social Security, fill out the worksheet scenarios on ssa.gov.

Another important and often overlooked element to consider is inflation. It is paramount for people to earn at least 3% on their money to meet inflation risk. For a quick illustration of how inflation can erode the purchasing power of your savings, check out this inflation calculator from the Bureau of Labor Statistics. Investment earnings can potentially compound over time making up this margin, and it’s never too late to start.

Roth IRA vs. Traditional IRA

Traditional IRAs are tax deductible and taxes are paid on funds when withdrawn. The tax break is upfront so this is good for people who need more money right now or are in a higher tax bracket now than they will be in retirement. Roth IRAs are not tax deductible, but the earnings are 100% tax free if withdrawn within the guidelines.

The Roth IRA is going to make more sense in some situations. Unfortunately, not everyone qualifies for a Roth. A person filing their taxes as single cannot make over $112,000. Married couples are better off, with a maximum income of $178,000 yearly.

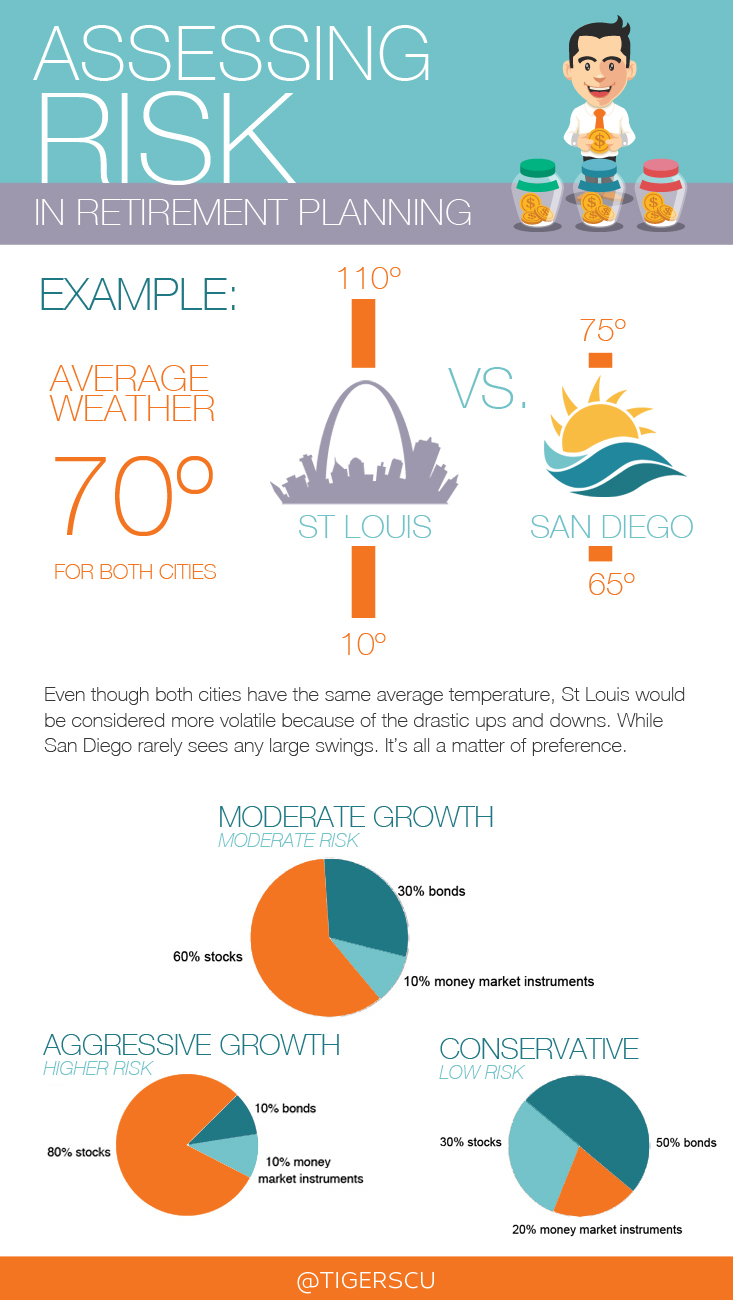

Stocks

Stocks have higher risk, but yield a higher return potential. By taking a risk and spreading some savings into other types of investments, we can sometimes beat inflation.

Bonds

In any scenario, bonds should be the base of your portfolio. They have less risk than stocks and a pretty good return. In short periods of times, they can have some fluctuations.

Money Market

There is not a lot of risk in money market instruments and you won’t make a killing in cash return. But the overlying theme is to diversify your portfolio with risk and safe options.

A major mistake in preparing for retirement is the fear of losing money and not taking risks. Most investors will probably need to take on some risk in order to get the returns they desire. The key is to know what to expect with the amount of risk willing to be taken. One way to do this is to look at historical returns for the type of portfolio you might have and make sure you are comfortable with the swings (losses and gains) you see.

ACTION PLAN

- Establish savings goals and make regular contributions to your retirement accounts.

- If you are over age 50, plan to make additional contributions as permitted by tax laws.

- Invest your savings to potentially outpace inflation.

- Keep wills and trusts updated as well as beneficiaries.

- Review your asset allocation regularly and make adjustments as you near retirement.

- Work with a financial advisor.

For additional information or to set up a free consultation for a personalized retirement plan, contact Investment Services.