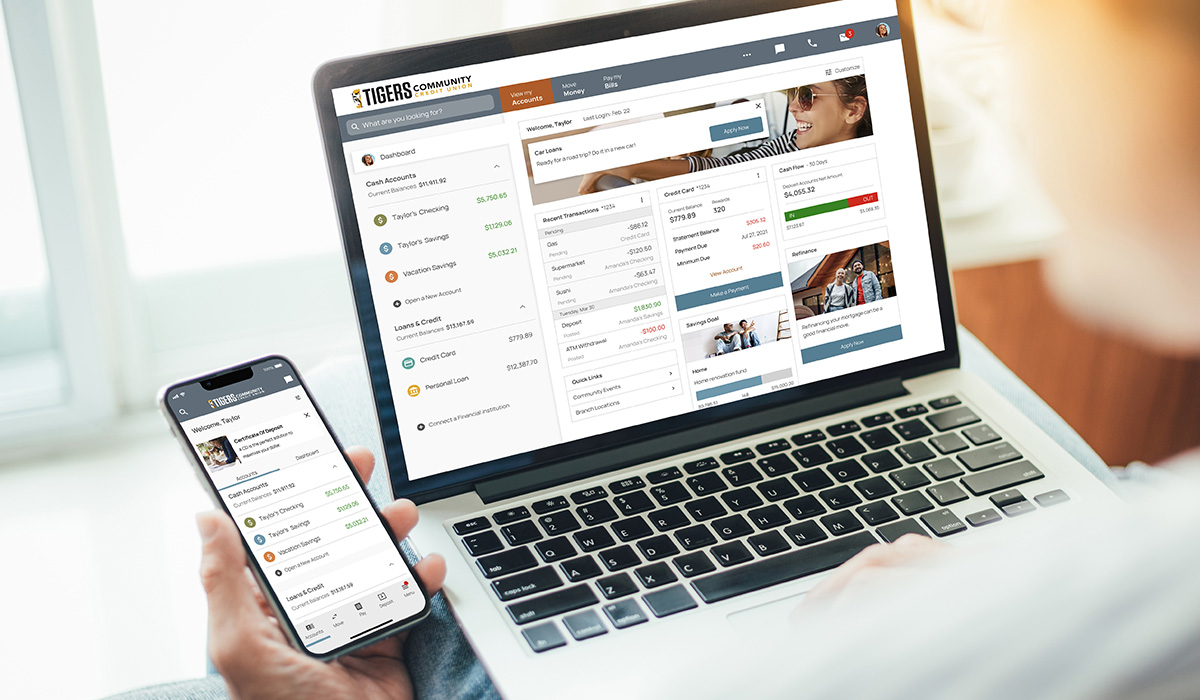

You may have noticed that the credit union’s Online & Mobile Banking dashboards have completely changed. We recently transitioned to an exciting new digital system that will help us manage the rapid growth we’ve experienced over the last several years.

This upgrade will allow our team to serve our members more efficiently, provide enhanced product offerings, and access to more robust digital banking experience. You’ll now be able to:

See all your credit union accounts in one place:

We decided it would be way more convenient for you if you could see EVERYTHING in one place. In the new Online and Mobile Banking dashboard you’ll continue to see all the accounts you’re accustomed to seeing, plus you’ll see your Credit Union Student Loans, Credit Card activity, and be able to manage your Debit and Credit Cards on your own.

Aggregate your accounts:

Now you’ll be able to take it a step further and add external accounts to your digital banking dashboard. You’ll have a single, secure place where you can see all your financial accounts.

Track your spending:

You’ll have real-time access to a spending analysis. You can conduct regular financial wellness check-ups, automatically calculate your forecasted spending, and much more.

Set real-time custom alerts:

We think one of the smartest ways to keep tabs on your accounts is with real-time alerts—so we added a lot of them! Alerts like a daily balance alert, Debit and Credit card transaction alerts, loan due alerts and a whole lot more! You’ll be able to set alerts and get the information you want, when you want it, and where you want it.

Open new accounts on your own:

While we love to see you in our branches, we know you’re busy. As a convenience we’re making it possible to open accounts on your own from within Online and Mobile Banking.

Plan ahead with savings goals:

We’re all about planning. You’ll be able to set a savings goal (or two, or three!), and we will automatically allocate the amount you specify from one account to another. Over time you’ll be able to reach all your long-term savings goals, like a vacation, kitchen remodel, or a deposit for a new car.

We want to thank our members for their patience and support as our staff learns our new system. You are an intricate part in our growth and success. We appreciate your engagement, feedback and commitment, and we could not be more excited to bring you improved service.

If you need assistance logging into the new Online Banking for the first time after the Upgrade or have any other questions about the system upgrade/new digital banking platforms, please refer to the Frequently asked questions.